Business Growth Vs Business Profits

The prevailing notion is that well funded startups don’t have to concern themselves with profits. They can kick the ‘profitabililty’ can down the road seemingly forever, even after going public. Just as long as the business continues to grow. The lesson of the failed IPO of WeWork and the less-than-stellar stock performance of Uber after it’s IPO is informative. A business truth that has been pushed under the carpet has been revealed.

EVERY BUSINESS HAS TO SHOW A PROFIT EVENTUALLY.GROWTH CANNOT CONTINUE FOREVER

On the flip side is the assumption, often quite incorrect, that after a business overcomes the challenges of the startup and high growth phases it can ‘breathe easy’ and not be as concerned with growth. It’s often looked at as the time to harvest all the profits that were put off from before. Amazon which successfully grew non-stop since its inception was able to “coast” for years without showing a big or any profit. In fact it took one quarter in 2017 to make the total amount of profit they had amassed in the 14 years prior.

Amazon knows that growth and profits have to work together though. It can’t be all of one and none of the other. Eventually someone has to ‘pay the piper’. Profits are needed to fuel the growth. Growth is needed to create more profits. The two may be in conflict at times, but a healthy business learns to make them symbiotic.

THE BUSINESS LANDSCAPE IS IN FLUX

The problem with taking the foot off the growth ‘gas pedal’ is that the macro economy and the marketplace are not static. Conditions change. New technologies and competition continuously nibble at your heels, if not sucker punch you in the gut. Focusing exclusively on profits without a long term strategic plan for continuous growth leads to an acceleration of the business lifecycle toward decline.

BUSINESS GROWTH HAS TO BE A FEATURE OF ANY STRATEGIC BUSINESS PLAN.

And don’t think that huge enterprises are immune from this fate. The canvas of business is strewn with example after example of companies that did not or could not continue their growth in successful manner. Today we are witness to huge conglomerates like GE and who are struggling mightily to get back into growth phase before it is too late.

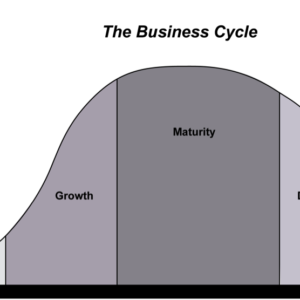

If we look at the typical business cycle as shown in the following diagram, we can see that once the big growth spurt of companies has come and the business is well established, the challenge is to avoid becoming complacent and too ‘present tense’ focused. This is the path to an earlier decline than might be expected.

Typical business life cycle from startup to exit

It’s important to note that the definition of growth also changes over the span of this typical business life span cycle. In the beginning growth is characterized by capturing more market share, introducing more products, expanding distribution, building capacity and expanding the workforce. These all take significant investment in capital and put pressure on cash flow.

However, this type of growth can’t be maintained indefinitely. For mature companies business growth has a different meaning. It means growing better internal operations and efficiencies – items that are often put off during the initial mad rush of the growth phase. Growth means creating stronger core processes. Leveraging the assets and resources in a systematic and more intentional manner.

Take Aways

- The need for profitability never goes away.

- Growth without a clear pathway to profits is a surefire way to hit the wall hard. SPLAT.

- Lack of attention to business growth will lead to a premature decline or demise of a business

- Lack of attention to business profits will lead to a capital and cash crunch that will lead to a demise of a business

![]()